Most financial advice is about numbers and logic — “Do you have enough saved for retirement?” “Are you on track to achieve your financial goals?” That’s all well and good, as rationality is important for investing. But humans aren’t robots; they’re emotional creatures whose feelings, fears and egos affect their decision-making. We must accept that investor behavior isn’t purely rational.

That said, the problem with emotions isn’t their existence — it’s how we respond to them. When emotion drives investment decisions, our clients can suffer. As financial advisors, it’s our responsibility to help our clients make smarter investing decisions.

Learn why emotional intelligence is a powerful tool for financial advisors looking to help clients make smarter decisions for their financial futures.

The Psychology of Investor Behavior

What is the psychology of investor behavior? Understanding this concept helps financial advisors diagnose why investors make irrational decisions — and develop strategies to overcome these tendencies.

Traditional financial advice, however, doesn’t take much time to consider psychology. This approach assumes that investors will always make rational decisions based on logical reasoning. This overlooks factors such as cognitive biases, social pressures and our biological reaction systems.

“When we get excited about something, our opportunity system is turned on; when we get frightened, our danger system is turned on,” says think2perform CEO Doug Lennick. “Both disable our ability to think clearly, and therefore, we will sometimes make irrational decisions.”

This lack of consideration for emotional decision-making can lead to poor investment choices. Investors may buy or sell based on the day’s events rather than sticking to fundamentals. They may chase market trends, succumb to fear during downturns or become overly optimistic during bull markets.

Furthermore, traditional financial advice often focuses on maximizing returns and beating the market, which can exacerbate emotional decision-making. An obsession with short-term performance can lead to excessive risk-taking and impulsive decisions. This increases volatility, disrupts long-term planning and often reduces returns.

Common Types of Investor Behavioral Bias

When we examine investor psychology, we can discover several common behavioral biases in financial decision-making. Here are five types of financial behavior to monitor.

Risk Aversion

Investors who are risk-averse gravitate toward low-risk, low-reward investments. They’re reluctant to take on perceived higher levels of risk, regardless of the actual danger. This behavior is driven by the fear of losing money and the desire to protect capital.

Risk-averse investors may be more inclined to invest in conservative assets, such as bonds or cash, rather than stocks or alternative assets. While accounting for risk is good, too much risk aversion can limit potential returns and long-term wealth accumulation.

Overconfidence

Investor overconfidence occurs when they have an inflated belief in their investing abilities and knowledge. This can lead to faulty predictions and an overreliance on guessing which investments will outperform.

Overconfident investors may take on excessive risk, trade more frequently and fail to adequately diversify their portfolios. This can result in poor investment performance and increased vulnerability to market volatility.

Herd Mentality

Herd mentality in investors occurs when people follow popular investing behaviors without making an independent analysis. These investors might believe other people have superior knowledge or information, or they might be too risk-averse to diverge from the consensus.

Following the herd isn’t necessarily bad, and no investor can possibly know everything about every asset. But when investors over-rely on consensus, they fail to investigate investment decisions. They don’t consider whether the default choice makes sense for their long-term goals or life circumstances. At the broadest level, the herd mentality can result in bubbles, where asset prices become detached from their underlying fundamentals. As we know, bubbles eventually burst, causing losses that investors might not be able to overcome.

Loss Aversion

Loss aversion is the tendency for investors to feel the pain of losses more strongly than the pleasure of gains. This behavior leads to irrational decisions, such as selling winning investments too early. Loss aversion also can hinder investors from regularly rebalancing portfolios for long-term performance.

Loss aversion is about the investor’s expectations of the probabilities. Loss-averse investors often overweight the worst-case scenarios, especially for larger bets. This prevents them from taking advantage of opportunities.

Anchoring Bias

Anchoring bias for investors occurs when they rely too heavily on a specific piece of information or reference point when making decisions. For example, we might anchor our expectations based on the initial purchase price rather than underlying fundamentals.

This bias can lead investors to anchor valuations on old information, even when that becomes outdated. Anchoring bias can prevent investors from adjusting their views and reacting appropriately to evolving market conditions.

Why Financial Advisors Need to Understand Emotional Intelligence

Emotional intelligence is your ability to recognize, understand and manage your emotions and respond effectively to other people’s emotions. For advisors, developing financial emotional intelligence can help you recognize the influence of emotions in your clients’ decisions — and use that awareness to respond effectively in the pursuit of long-term financial goals.

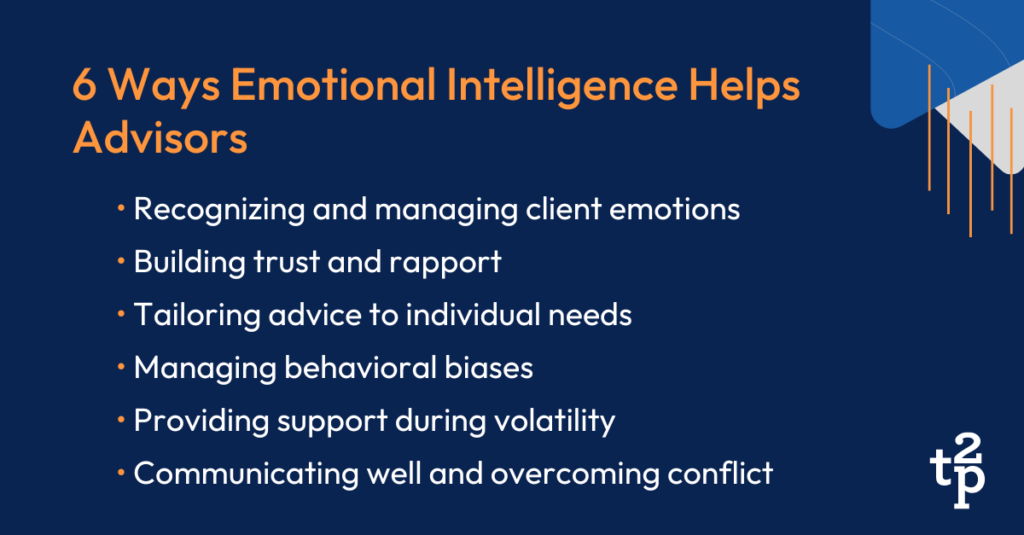

Here are several ways using emotional intelligence helps financial advisors.

- Recognizing and managing client emotions: Clients might not realize the extent of their emotions or how those feelings affect their actions. By acknowledging and addressing these emotions, advisors can guide clients toward more rational and informed choices.

- Building trust and rapport: Emotions are natural and OK. Clients shouldn’t feel bad about these emotions. When advisors understand and empathize with their clients, they create a safe and supportive environment where clients feel comfortable discussing their hopes, fears and values. When clients trust you, they’ll share more information, which helps you give better recommendations.

- Tailoring advice to individual needs: Emotional intelligence enables advisors to tailor their advice and recommendations to each client’s values, goals and emotional drivers.

- Managing behavioral biases: Emotional intelligence helps advisors recognize and manage clients’ behavioral biases — and their own. By understanding common biases such as loss aversion and herd mentality, advisors can help clients adapt and make more rational decisions.

- Providing support during market volatility: Rapid swings in the market can cause fear or excitement, depending on the circumstances. Financial advisors with emotional intelligence can provide emotional support to clients, helping them work through their concerns without abandoning the financial discipline required to achieve long-term results. When clients feel supported, they’re less likely to make an impulsive decision to soothe their worries.

- Communicating well and overcoming conflict: Financial advisors who practice emotional intelligence understand that conversations about investments can be complex, even difficult. These advisors adapt their communication style to meet each client’s needs. If there’s a disagreement or conflict, they can keep their cool and seek mutually beneficial outcomes.

How to Use Emotional Intelligence With Clients

Financial advisors might be familiar with the ideas behind emotional intelligence, but your clients might not. Moreover, they might struggle to separate their emotions from the facts during moments of stress and uncertainty. Here are a few ways to deploy emotional intelligence and improve investor behavior.

Educate Them About Their Emotions

Help clients understand the ideas behind emotional intelligence and how to put them into action through self-awareness and emotional regulation.

Highlight the benefits of understanding and managing emotions in the context of investing decisions. Emphasize that emotions can cloud people’s judgment and lead to impulsive or irrational actions. By helping clients understand that this isn’t a personal failure but rather a factor they can control, advisors can help clients become more self-aware and take steps toward rational decision-making.

Because investing decisions can be stressful for clients, they might feel bad about their irrational thoughts or actions. Financial advisors must demonstrate empathy as they help clients reorient themselves. Consider how showing vulnerability can improve your chances of connecting with clients and influencing their choices.

“I’m certainly not saying you should be a feelings fire hose, but it is useful to acknowledge what people are going through, make them feel like they’re not alone,” Liz Fosslien said on an episode of Making the Ideal Real.

Guide Them Toward Better Financial Behaviors

Before you can change investor behavior, you need to build trust and rapport. Actively listen to client concerns about anything that affects investing decisions, such as market fluctuations, economic worries or personal challenges. When you demonstrate empathy and understanding, you help clients feel heard and valued, increasing their engagement in the financial planning process.

And by understanding clients’ unique circumstances and emotional drivers, you can now tailor your guidance to align with clients’ values and long-term goals.

Financial advisors also can use emotional intelligence to better understand client wants and steer them toward realistic and achievable goals. By breaking down larger objectives into smaller, manageable steps, clients are more likely to stay motivated and make progress. Advisors can provide ongoing support and accountability, helping clients stay on track and feel engaged in the process without resorting to emotional decision-making.

Apply Behavioral Financial Advice

Behavioral financial advice integrates emotional intelligence into financial planning. It recognizes that emotions and biases significantly impact financial decision-making. By helping clients recognize their behavioral biases and set strategies to overcome them, you can influence their choices for the better.

Behavioral financial advice focuses on the client’s values when setting goals, with the understanding that those values (and, subsequently, those needs) change over time. This approach can be a powerful tool during periods of extreme market volatility or when a client experiences personal upheaval. The emotionally intelligent advisor can work with the client to determine whether their emotions are driven by short-term events or meaningful shifts in their underlying values.

Influence Financial Behavior With Emotional Intelligence

No matter what situation you’re in, “emotions are going to play a part in people’s lives and their experiences,” Lennick said in an episode of Making the Ideal Real. “And therefore, I think learning how to deal with emotions will remain a relevant topic.”

Financial advisors have a powerful opportunity to help clients recognize their emotions, regulate them and make better decisions that lead to long-term success. Start by educating yourself about emotional intelligence and your own biases so you can be a steady, empathetic resource for your clients when they most need you.

Looking to deepen your relationship with clients, improve their decision-making and help them reach their financial goals? Learn more about our Behavioral Financial Advice program.