Our actions dictate our impact in life. And when we align our values and goals, and our goals with our behaviors, we can achieve even greater success in our relationships, careers, financial decisions and more. Unfortunately, as financial advisors, you have witnessed time and time again the results of misalignment — purchasing a brand-new car, stretching for a new house, or the lavish vacation — on the likelihood of your clients achieving their financial goals. Fortunately, you can support your clients by creating alignment with their values and their financial goals so you can begin to advise on behavior — and that’s where behavioral coaching can help.

Behavioral coaching can support rational client decision-making even during challenging and stressful times. This approach helps financial advisors act according to their values, too, which matters because clients watch everything you do.

“We judge others based on their actions and behaviors. We judge ourselves based on our intentions. But you, for example, will judge me based on my actions and behaviors,” says Ray Kelly, senior vice president and consultant at think2perform, in an episode of Making the Ideal Real.

With that in mind, learn about what behavioral coaching is, its benefits for financial advisors and clients, and why values alignment is so important to this approach.

What Is Behavioral Coaching?

Behavioral coaching, in the context of financial advisors and financial planners, refers to a process that helps clients align their investing behaviors with their values and goals.

This approach considers the psychological factors that influence decision-making and behaviors. Financial behaviors aren’t solely driven by rationality and logic, as many traditional approaches to investing assume. People are influenced by their emotions, biases and other cognitive processes in everything they do, including investment decisions.

“For example, when we get excited about something, our opportunity system is turned on; when we get frightened, our danger system is turned on,” notes think2perform CEO Doug Lennick in discussing how humans handle uncertainty. “Both disable our ability to think clearly, and therefore, we will sometimes make irrational decisions.”

Recent research by Vanguard has found that a financial advisor’s advice is worth up to 3% net of fees return to the client. Of that 3%, 150 basis points (bps) are attributed to behavioral coaching. That is half of the return to the client!

By addressing these factors as a behavior coach, financial advisors can help clients understand their emotions, overcome obstacles and make more informed choices that support long-term goals and have measurable business impact for the client.

Why Values Alignment Leads to Better Behaviors

Values alignment is crucial for improving financial behaviors and achieving better outcomes. We advocate for the importance of behavioral finance, as advisors need to understand their clients’ emotions, fears and values, not just their financial fundamentals.

When people align their behaviors with their personal values, several benefits arise:

- Clear direction and purpose: When clients understand how their values connect with behaviors, they have clear direction for making financial decisions. No matter what happens in life, they always have a North Star of what truly matters to them. And should their values change over time, they can realign their purpose and behaviors.

- Informed decision-making: Values alignment enables people to make more informed decisions based on their personal principles and beliefs. By considering their values, people can evaluate the potential impact of their financial choices and make rational decisions even in turbulent markets or stressful situations.

- Consistency and integrity: Living in alignment with your values promotes consistency and integrity in financial behaviors. People build trust with others — and in themselves and the decisions they make. They’re prepared to make long-term financial decisions that are monetarily sound but also ethical.

- Stronger emotional well-being: Values-based behaviors contribute to a sense of fulfillment, satisfaction and personal growth. Living an authentic, aligned life can reduce internal conflict, self-doubt and regret while increasing emotional intelligence.

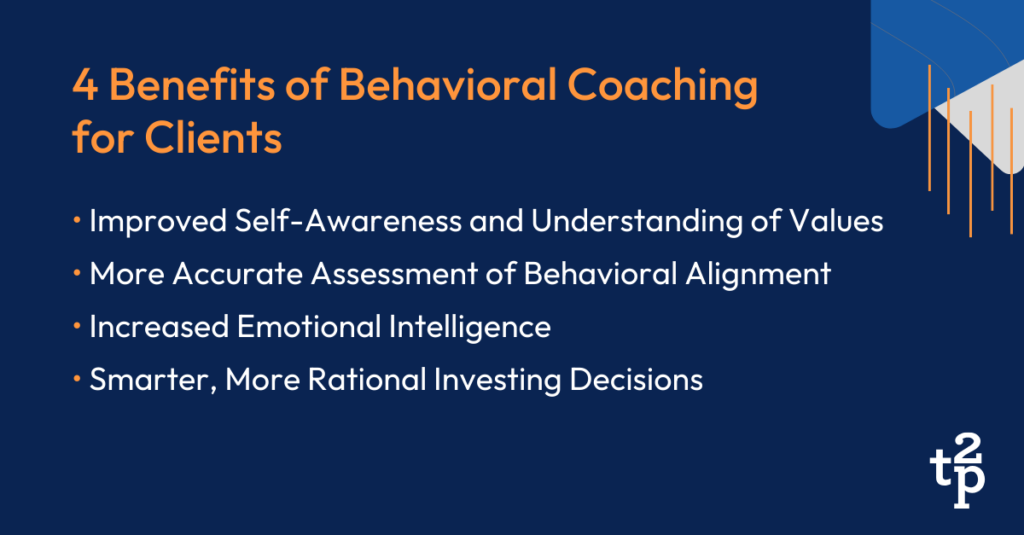

4 Benefits of Behavioral Coaching for Clients

Behavioral coaching can help clients gain self-awareness of not only their behaviors but also what drives them. By exploring the connections between their values, beliefs and financial decisions, clients can identify misalignments. From there, financial advisors can help clients develop strategies to overcome biases, navigate triggers, and make intentional and value-aligned financial choices.

Here’s an overview of the main benefits for clients who have a financial advisor that acts as a behavioral coach.

Improved Self-Awareness and Understanding of Values

Before you can align your values and behaviors, you need to know what you value most — and it’s often more than money and wealth. Health, family, friends and countless other values can influence people’s behavior and their investment strategies.

Financial advisers should gain clarity on client values, especially early in the relationship, before assessing behaviors or making big investing decisions. Make sure clients understand and can state their core values. This self-awareness sets the stage for seeing whether clients live in intentional and purpose-driven ways that align with their beliefs.

More Accurate Assessment of Behavioral Alignment

Once clients understand their values, financial advisors can help them contrast those values against current behaviors.

Through coaching sessions, clients can explore how their values shape their financial decisions and identify any inconsistencies or conflicts between their values and behaviors. Advisors can help clients adjust their behaviors based on this new comprehension of what truly matters to them.

Increased Emotional Intelligence

Cognitive intelligence is important but not sufficient for strong financial decision-making. Advisors and clients alike need emotional intelligence, or the ability to understand, manage and apply emotions effectively.

When advisors act as behavioral coaches, they help clients learn to recognize and regulate their emotions, including when making financial choices. Over time, they’ll learn to make rational and objective decisions, even during times of market volatility or personal stress.

There are many ways to develop emotional intelligence. One simple exercise is the “4 Rs” process of Recognize, Reflect, Reframe and Respond. Using these four steps helps interrupt autopilot reactions that arise from emotional or cognitive triggers.

Smarter, More Rational Investing Decisions

All of these benefits ultimately support smarter and more rational investing decisions that aren’t sidetracked by biases or emotions. Financial advisors can use behavioral coaching techniques to help guide clients through market fluctuations, manage their risk tolerance and stay focused on long-term investment strategies.

Importantly, if clients do decide to change their investment approach, they’ll do so in alignment with their values rather than being swayed by short-term market trends or emotional reactions. They’ll feel even more comfortable acting rationally when they know they have a trusted advisor supporting them throughout.

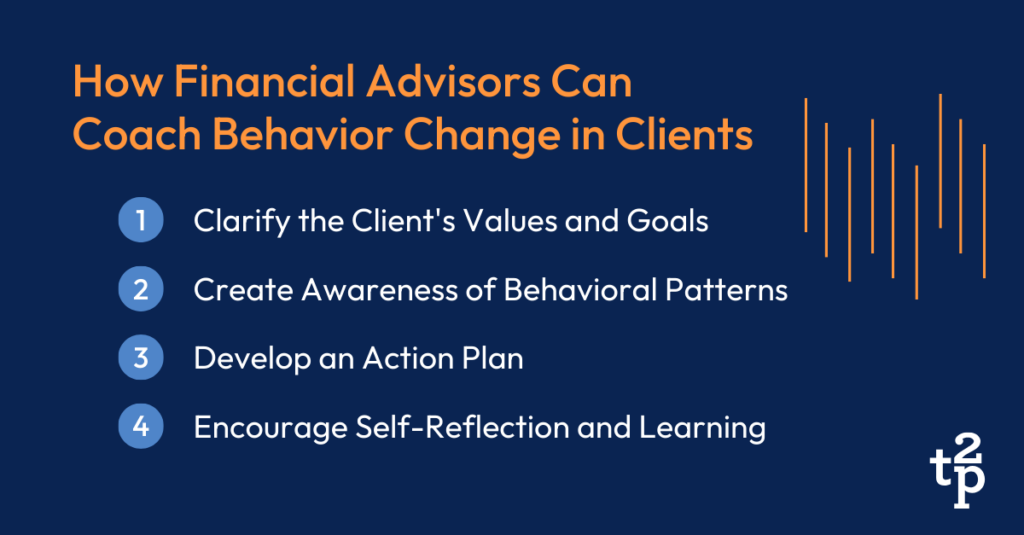

How to Coach Behavior Change in Your Clients

People naturally resist change, especially when it feels difficult, so they benefit from a safe and nonjudgmental space to explore their financial behaviors, beliefs, worries and goals.

Through active listening, effective questioning and feedback, behavioral coaching helps investors understand their behaviors and thought processes and check for alignment with their values. Here are some steps financial advisors can take when coaching clients to align their values and behaviors.

Clarify the Client’s Values and Goals

Begin by working with your client to uncover their values and financial goals. This can be in conversation or as part of a formal values exercise. Help clients identify misalignments between their values and current behaviors.

This process allows clients to gain clarity on what truly matters to them and how their behaviors can support their values and goals. Gaining clarity on existing values and behaviors helps financial advisors guide clients toward the best investment decisions for their circumstances and needs — and, in some cases, picking different goals.

Create Awareness of Behavioral Patterns

Many behavioral assessments exist to help financial advisors and clients identify patterns and biases that may influence financial decision-making. Ongoing conversations also can help both parties gain trust, especially during a new advisor relationship or market turbulence.

Once patterns are identified, discuss their impact on financial outcomes. When clients recognize their behavioral tendencies and triggers, they can assess whether they live in alignment with their values — and where they need a new approach or further guidance.

Develop an Action Plan

Co-create strategies with clients to address specific behavioral challenges they may face. Identify potential obstacles that may arise during the behavior change process, along with contingency plans to overcome them.

Encourage clients to track their progress and celebrate small victories along the way. This action-oriented approach helps clients stay motivated and focused on their goals. Like investing, behavioral change is a long-term process with many small milestones along the way.

Encourage Self-Reflection and Learning

Encourage clients to regularly reflect on their behaviors and the resulting outcomes. A less-than-optimal result isn’t necessarily a bad thing, especially if the behavior aligns with values. Whatever the circumstances, urge clients to identify lessons learned and areas for further growth.

By fostering a mindset of continuous learning and self-reflection, clients can deepen their understanding and make adjustments. Throughout, financial advisors should help clients connect this journey to attaining their long-term investing goals.

Embrace Behavioral Coaching for Client Success

Financial advisors don’t have to fix their clients’ lives, but they can be a powerful font of knowledge, support and guidance. Behavioral coaching is a proven tool for helping clients make values-informed financial decisions, but it’s also a way for them to make holistic life improvements.

When financial advisors learn how to coach behavior change, they can change lives, not just finances. And, best of all, they can apply these principles in their own practice and with their employees. We can all benefit from living a life where our behaviors and values align.

Want to go deeper? Learn about our Behavioral Financial Advice program, including the BFA certification.